- Paula Faris Official

- Posts

- PFO Newsletter- 05.16.25

PFO Newsletter- 05.16.25

You're the First to See! Plus, budgeting tips and a giveaway!

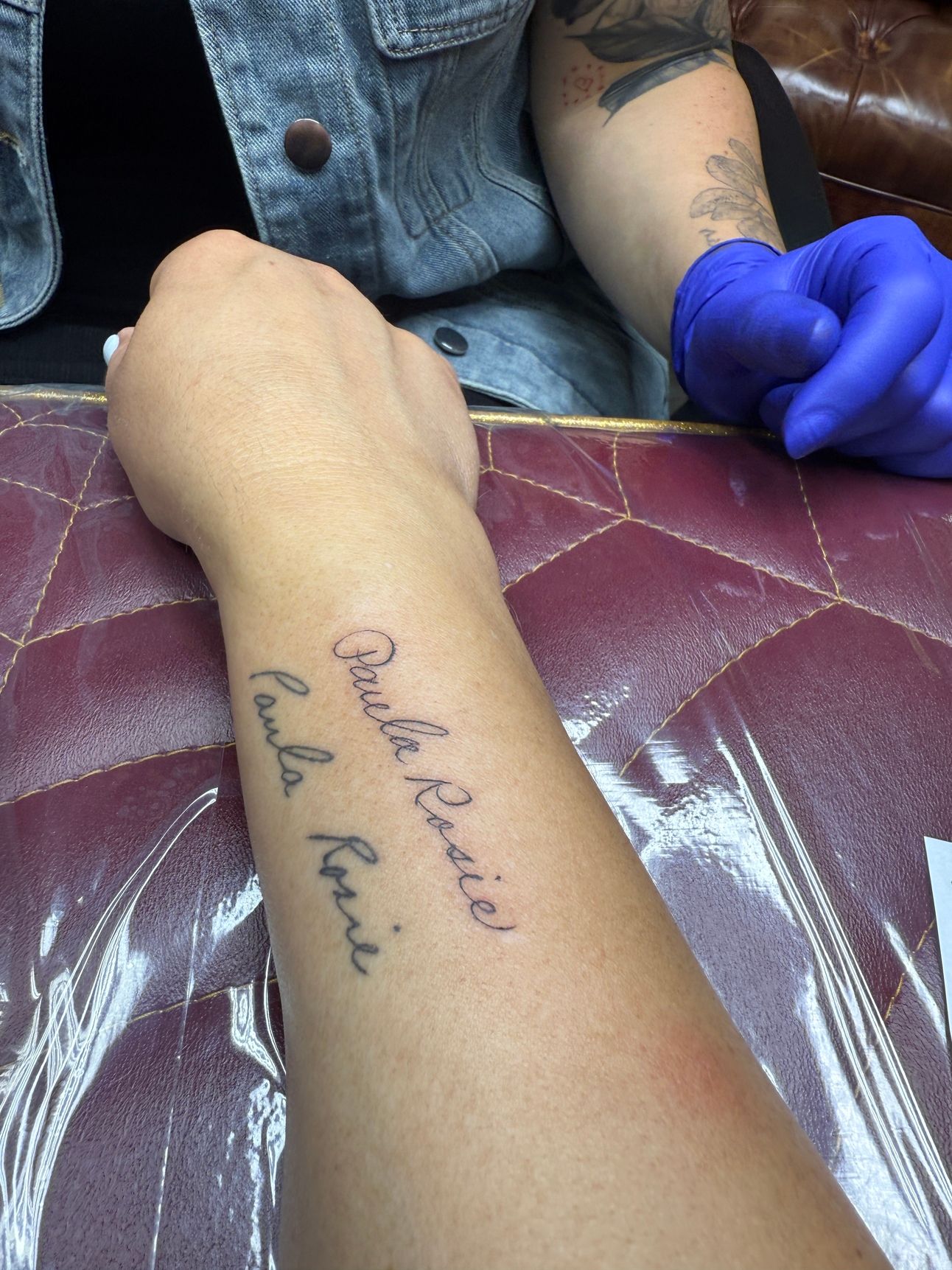

I did it. And you’re the first to see it.

I’ve been wanting to do something really special to honor my mom, similar to what I did with my dad after his passing. And I’ve shared with you that I’m really struggling with her death, even more so than with my dad’s. (That’s why I’ve thrown myself into things like gardening, sandblasting, power washing, etc.--it’s been therapeutic)

Just this morning I got a tattoo of mom’s handwriting.

Both my parents called me “Paula Rosie” (my middle name is Rose) so I took my old greeting cards from them (yes, I saved them) and the tattoo artist used those cards to replicate their handwriting. I had dad’s tattoo done about a year ago. Now, it’s complete with my mom’s.

I can’t even describe how special this is to me. Every time I look down at my arm, I see my parents handwriting and can almost audibly hear them calling my name. I’m so grateful to share this with all of you.

In other news, a hot topic amongst this community has been budgeting. It’s something John and I have consistently struggled with and often feels very restrictive.

It’s been a great couple of weeks on the podcast, with financial expert Rachel Cruze sharing easy ways to budget as a family (this week’s episode), plus how we can teach our kids about money (last week’s episode). I’d love to hear your thoughts on budgeting!

This is a no judgment zone–but almost 80% of us are living paycheck to paycheck and credit card debts are at an all time high. That is a tough place to be and puts a ton of pressure on us and our family dynamic. Rachel answers your questions about money and gives us some creative ways to save. Even John was surprised and enlightened, which is tough to do. :) Make sure you check out the conversations.

Keep reading for my favorites, plus a fun giveaway. Speaking of, congrats to Diane, Kelly, Melissa, Angel and Brianna Leigh for winning our last giveaway, a copy of Dr Carla’s Naumburg’s book How To Stop Losing Your Sh*t With Your Kids—a hilarious and helpful read for all of us who routinely lose our cool.

Have a wonderful weekend, friends. Today, I’ll sign off like this…

-Paula Rosie xo

FARIS FAVORITES 🤎

1. The BEST way to preserve your kid’s “artwork”

If you’re anything like me, all your kids’ art work (even if they’re already grown) is tucked away in a bin, waiting for the day to go through it. Even those larger, clunkier clay projects they made, in the name of “art”. Ha. I’ve got a solution for you–turn it into an art book from PLUM PRINT! Capture the moments but cut down on the clutter. This is something I’ve done with all three of my kiddos and I’ll cherish the books forever. Use the code CARRY for 50% off. Plus, feel good knowing they’re mom-owned!

2. GIVEAWAY: The most ADORABLE children’s books!

GIVEAWAY: Speaking of books…my dear friends and counselors Sissy Goff and David Thomas released their precious children’s books this week and we’re giving away FIVE sets! Lucy Learns to Be Brave + Owen Learns He Has What It Takes You know the drill: DM me your mailing address.

3. How to get EASY PROTEIN

I can’t stop talking about my new favorite protein powder (because we all have protein goals, right?). In my quest for a protein powder that tastes excellent just mixed with water, I’ve discovered The Peachie Spoon. I drink it first thing in the morning to get 25g of protein OUT OF THE GATE. Use my Code PAULA for 12% off! One bag lasts a month.

POLL RESULTS:

In our last poll, the majority of you (51%) said you’re NOT worried about the low U.S. birth rates. Your comments were so insightful and varying, so I included more than normal. Enjoy!

➡️ “It is reflective of the Gen X experience. Student debt, stagnant salaries, high cost of housing has led them to be unable to support children and the costs of childcare and support. They are one of the first generations to be less well off than their parents. ”

➡️ “I am not worried about the birthrate. I know many families here where I live that have many children and just cannot afford to live comfortably. Although I know having children is one of the best things to happen to a person, if you cannot afford to feed and clothe them it is really hard to enjoy raising them. I am so happy that women now have the choice of how many children they want or not to have children at all. I never want there to be laws to send women back to the dark ages and not have access to family planning. If we are running out of children, then we can invite more immigrant families to come to the US. They would be happy to come.”

➡️ “So very sad. Nothing more fulfilling than family. We are falling away from faith and the important things in life. Thank you for embracing this issue, Paula! Moms need more support. ”

➡️ “There are already people who have multiple children in their families that are not equipped to financially support all of them. Also, we already have a lot of Americans who can't get benefits for housing, food & clothing. There are many children out there ready to be adopted. I believe that is where our focus should be.”

➡️ “Paula’s statistics are so sobering! Can anything be done to reverse this alarming trend? I hope so.”

➡️ “Sometimes I wonder if I’m being selfish because of being almost 30 years old and not having already had a baby predominantly due to my career. I believe I am walking in God’s will and my husband and I are still preparing ourselves to steward a family well. When I think about the way the world is going though, I feel I need as much preparation as possible- it seems a bit scary to bring a child into the world today. Anyway, the topic does fascinate me!”

➡️ “Until we focus on sustainability in our current environment, we won’t be able to maintain or sustain feeding more people in our country or world.”

➡️ “A person shouldn't be pressured into having kids when they're not ready to have them or if they don't want to have kids. ”

➡️ “There are too many people on the planet now. ”

THE PAULA FARIS SHOW 🎙️

Allowances, Hustles, and Hard Truths: Raising Money-Smart Kids with Rachel CruzeHow do you teach your kids to actually handle money—and not just spend it? In this episode, Paula sits down with personal finance expert Rachel Cruze to break down practical ways to raise financially confident kids. Rachel shares why it’s important for kids to earn their own money early through chores, learn to divide it between saving, giving, and spending, and even open their own checking accounts before they leave home. Plus, the hilarious story of how Rachel and her sister hustled snacks at their dad’s office (Dave Ramsey!)—and what it taught them about real-world money skills. Rachel also explains why a little struggle is healthy—and how letting kids make small financial mistakes now can save them from major ones later. If you want your kids to grow up with real-world money smarts (and grit), this conversation is a must-listen. |  Easy Budgeting for Families: Rachel Cruze Talks Simple Ways to Get Your Money on TrackRachel Cruze is back for Part 2 of our conversation, and this time, we’re tackling the B word—budgeting! Now, if you’re like me, you might have a love-hate relationship with this whole budgeting thing. It sometimes feels too restrictive, too many numbers, and honestly, a little boring. My husband and I have definitely struggled with sticking to a budget, and when it comes to managing family expenses, we’ve had our share of chaos. (our grocery bill alone could feed a small army). Rachel, a financial expert and former “anti-budgeter” says that budgeting isn’t about limiting fun—it’s about creating freedom and giving every dollar a purpose. Now, before you think “ugh, spreadsheets,” she’ll be sharing super-simple, doable budgeting strategies to help families like yours get your finances on track without feeling overwhelmed. Whether you’re trying to reign in out-of-control food costs (yep, Rachel hears me on that!), tackling credit card debt, or just trying to get ahead financially, this episode is packed with tips you won’t want to miss. Key takeaways: How to use a zero-based budget to take control of your finances. Why budgeting doesn’t have to be complicated—and how to avoid getting stuck in a system that doesn’t work for you. Practical tips for saving on food and managing other family expenses. How to break free from the cycle of credit card debt with simple strategies. Plus, Rachel shares a game-changing budgeting tool—the EveryDollar app—that I’m trying out myself! Will you join me on this budgeting journey? |

Join the Conversation!

If you’ve made it this far, I invite you to join (or start) the conversation in our comments section. What would you like to share? -Paula

Reply